Taiwan’s central bank cautions industry of a possible real estate bubble

Several raised concerns about the swift pickup of local property deals and prices

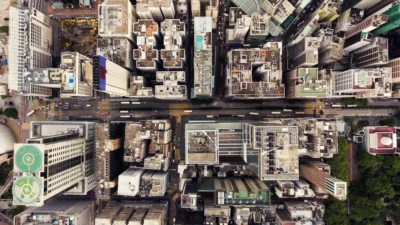

The board of directors of Taiwan’s central bank revealed that they are worried about a potential return to ‘property fever’, advising the industry to take careful steps to prevent bubbles from forming in the real estate market, reported the Taipei Times.

Most of the members felt anxious about the boost in local property deals and prices, somewhat encouraged by extremely low-interest rates across the globe, which were introduced to help ease the impact of the pandemic.

“The central bank needs to heed the signs of bubbles forming in financial assets and the real estate market, and put together precautionary policies or formulate response measures,” said one of the directors.

More: How Taipei, Songdo lead smart cities by example

The director explained that adaptive monetary policies locally and abroad continue to propel the circumstances, coupled by the US Federal Reserve’s determination to ensure that interest rates are near zero for three more years at best.

Another director agreed, stating that they must actively oversee shifts in the market to respond accordingly before the public perceives a rise in home prices.

As soon as the public gets a hold of the said perception, the director believes that it would be extremely complicated to undo the trend, even if measures, such as tax-based policies or loan-to-value restrictions are introduced.

Recommended

6 reasons why Bang Na is Bangkok’s hidden gem

This Bangkok enclave flaunts proximity to an international airport, top schools, and an array of real estate investment options

AI transforms Asia’s real estate sector: Enhancing valuation, customer interaction, and sustainability

From property valuation to measuring sustainability, AI is impacting nearly every aspect of Asia’s real estate industry

Bangkok’s luxury real estate flourishes amid economic challenges

New luxury mega projects boost the top end of Bangkok’s market, but stagnancy reigns elsewhere due to weak liquidity and slow economic growth

Investors shift focus to suburban and regional markets as Australian urban housing prices surge

Investors are gravitating to suburban areas and overlooked towns as Australia’s alpha cities see skyrocketing demand and prices