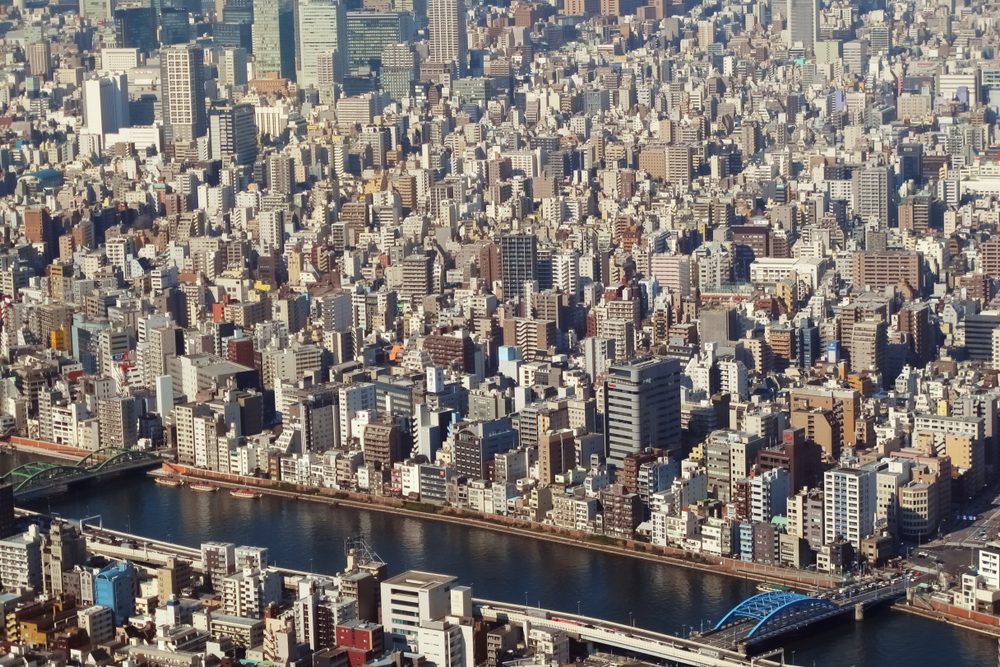

New data reveals highs and lows in Japan’s land prices

The average price of land in Japan fell for the second consecutive year amid the prolonged pandemic

Based on government data, the average price of land in Japan has declined for the second consecutive year during the ongoing pandemic, recording a 0.4 percent drop as of July 1 since a year earlier, reported The Japan Times.

According to data by the Ministry of Land, Infrastructure, Transport, and Tourism, prices of commercial land decreased, reflecting the inactive demand for shops and hotels as a result of COVID-19.

The average land price in Japan’s three largest metropolitan areas (Tokyo, Osaka, and Nagoya) slightly increased by 0.1 percent, while that of the Osaka area only saw declines.

The survey included average prices for all types of land across Japan, namely residential, commercial, and industrial, following the value of 21,443 sites nationwide.

The average price of commercial land dropped 0.5 percent from a year earlier, a sharper decrease than 0.3 percent recorded last year, while 41 of the country’s 47 prefectures saw declines, compared with 36 prefectures in the previous year.

By region, the Osaka area saw average commercial land prices fall for the first time in nine years. Data shows that the Dotonbori district had the largest drop nationwide at 18.5 percent.

Meanwhile, the Nagoya area recorded a rise in average commercial land prices, as well as the Tokyo region and the cities of Sapporo, Sendai, Hiroshima, and Fukuoka, partly due to urban redevelopment projects.

Additionally, the average price of residential land nationwide dropped 0.5 percent from a year earlier, slowing from a 0.7 percent decrease last year. In total, 38 prefectures saw their residential prices fall, compared with 42 the previous year.

Low-interest rates have sustained housing demand even during pre-pandemic times, driving up residential land prices near train stations and elsewhere.

By region, Tokyo and Nagoya marked rises in residential land prices, while the average price in areas outside the three largest metropolitan areas fell 0.7 percent.

The survey revealed that the island city of Miyakojima, Okinawa Prefecture, saw the highest price jump for residential land of 22.9 percent, supported by resort development.

More: Data shows Japanese buyers don’t appear to buy properties outside the city

Kuma village in Kumamoto Prefecture, hit by flooding in July 2020, recorded the steepest fall in residential land prices of 19.2 percent.

Moreover, industrial land prices increased for the fourth straight year due to the high demand for logistic facilities, induced by the expansion of online shopping.

The Property Report editors wrote this article. For more information, email: [email protected].

Recommended

6 reasons Bekasi is rising as Greater Jakarta’s next hotspot

One of Greater Jakarta’s rising stars is prospering, thanks to ample recreation and a contingent of desirable housing projects

6 developments driving Asia’s green real estate shift

Developers are being incentivised to push a green agenda into daring new realms

The Philippines’ LIMA Estate drives sustainable industrial growth

LIMA Estate models a citywide vision that uplifts workers while appealing to climate-conscious employers

Malaysia property market rebounds with foreign interest and growth

The nation’s property market is stirring to life, fuelled by foreign buyers and major infrastructure drives