A shot at recovery for Malaysian real estate

The devastation wreaked by the pandemic on Malaysia’s economy is clear for all to see, but government stimulus packages and financial incentives are riding to the rescue of the country’s real estate sector

With stimulus funds being thrown around like so much confetti, the pandemic has highlighted the extent to which governments can provide financial succour to their people.

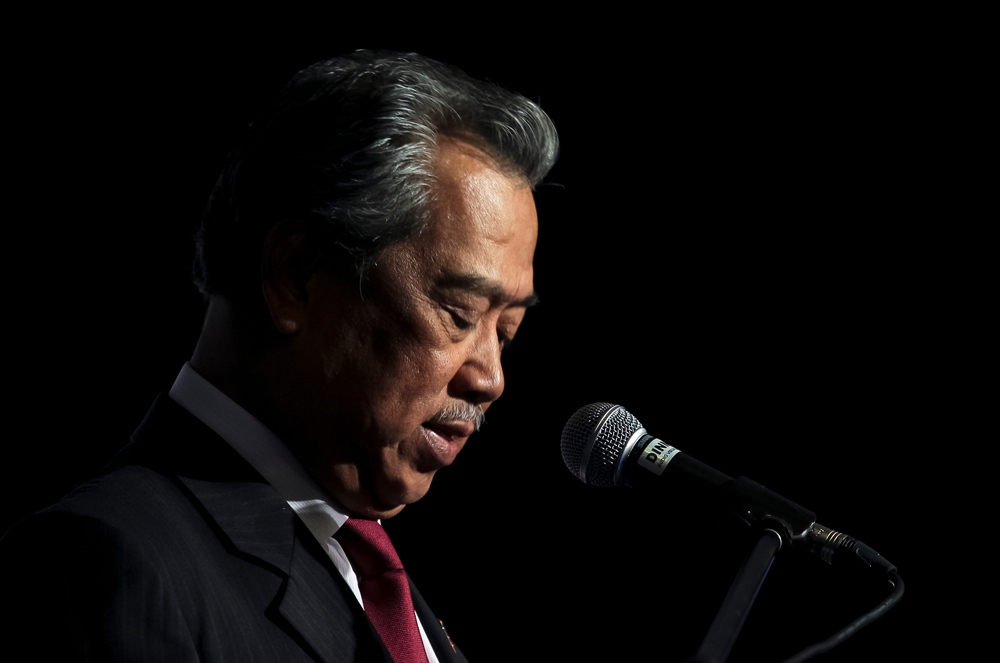

Malaysia has unfurled one package after another since the virus took hold in the nation in January 2020. One year later, King Al-Sultan Abdullah would declare Emergency (Essential Powers) Ordinance 2021, suspending parliament and postponing elections at the request of embattled Prime Minister Muhyiddin Yassin.

On the face of it, the move was merited; so was federal administrative capital Putrajaya’s version of the lockdown, the Movement Control Order (MCO). Malaysia, after all, had the third-highest Covid-19 caseload in Southeast Asia.

In a narrative replicated with some variations across the region, GDP growth in Malaysia last year contracted by 5.6 percent, the steepest economic plunge since the 1998 Asian financial crisis. Overall property transactions plunged almost 28 percent by volume—31.5 percent by value—in the first half of 2020 from the same period in 2019, according to figures from the National Property Information Centre (NAPIC). Transaction volumes and values within the residential segment alone plunged 24.6 percent and 26.1 percent, respectively, as sales rates hit a low of 3 percent.

“A lockdown implicates more than physical restriction,” says Foo Gee Jen, group managing director of CBRE WTW. “It creates uncertainty as economic activities are hindered. This then poses an unemployment risk. The consequent weakening of consumption confidence placed on the residential sector is at the forefront of Covid-19 impacts.”

Malaysians had not faced a state of emergency for more than 50 years before the ordinance. The sweeping law, which lets Muhyiddin latch onto the premiership “until the pandemic is over”, he says, has drawn reprobation from parliamentarians, human rights activists, and legal experts around the region.

“The word ‘emergency’ itself will give a poor perception of Malaysia security,” says Tan Hui Yin, partner with Tan Chap & Associates and judge at PropertyGuru Asia Property Awards (Malaysia). “Under an emergency, there is no control over the executive, and without parliamentary control, the executive will follow a flipflop policy. The ever-changing SOP (standard operating procedure) for the pandemic is a good example.”

The speculative element will continue to be under check, and price and product rationalisation will be seen as key elements in the creation of a more resilient and demand-driven residential market

The protean nature of the MCO, which has gone by turns from strict (Enhanced Movement Control Order) to, some say, inconsistently relaxed (Conditional Movement Control Order and its successor Recovery Movement Control Order), has caused supply to undulate, with developers eager to seize upon every window of opportunity. The easing of restrictions towards the end of 2020 caused supply to soar by 10.14 percent annually in the third quarter of 2020, reports PropertyGuru Malaysia. Asking prices slipped 0.34 percent year-on-year in the final quarter, ahead of the reimposition of restrictions (MCO 2.0) in January.

Combined with a low-interest-rate environment—the Overnight Policy Rate (OPR) stands at 1.75 percent, the lowest in history—the downward pressure on prices has helped create “the most conducive lending and policy environment” in recent years, notes Sheldon Fernandez, country manager of PropertyGuru Malaysia.

Widespread changes to the pricing structure would likely offer greater value for money, according to Prem Kumar, deputy managing director of Jones Lang Wootton and jury chairperson of PropertyGuru Asia Property Awards (Malaysia). He says: “The speculative element will continue to be under check, and price and product rationalisation will be seen as key elements, accordingly, in the creation of a more resilient and demand-driven residential market.”

Negative sentiment in the property market had been percolating since 2019. GDP growth that year was only 4.3 percent, the lowest since the 2009 global financial crisis. The overhang remained pervasive, increasing from almost 59,500 units in the first half of 2019 to 63,063 units in H1 2020, NAPIC data shows. In Johor, the overhang numbered 19,000 units, comprising high-rise homes, condominiums, and serviced apartments.

“The stratified residential market had been experiencing a downtrend even before the pandemic,” says Kumar. “The supply of condominiums and serviced apartments has not reached market equilibrium vis-à-vis demand and, as such, will continue in the short term to exceed demand.”

International buyers have left locals to fend for nearly 47,500 prime and luxury units in Greater Kuala Lumpur, where average capital values hovered at MYR1,009 (USD250) per square foot, according to recent Jones Lang Wootton data. Sales for luxury homes in Klang Valley trended down to 75.4 percent in Q3 2020, the slowest momentum since 2010, reports CBRE WTW. Mayor of Kuala Lumpur Datuk Mahadi Che Ngah has since vowed to promote affordable housing and build transit houses for low-income renters.

“The root causes of the overhang extend beyond pricing,” says Foo. “Mismatches in terms of location and product cannot be taken out of the context of overhang. While the current soft market and anticipation of lesser new launches will help to prevent the residential market from overheating, developers must step up on feasibility assessment going forward to effectively mitigate overhang risk.”

As it is, the bottom 40 percent of income earners, the B40, make just enough to own homes worth less than MYR300,000. However, only a little over 10,000 units of them were in stock as of H1 2020, according to the Valuation and Property Services Department (JPPH).

Budget 2021, Muhyiddin’s first and the nation’s biggest ever at MYR322.5bn, extends a helping hand to the property-seeking rakyat. The sweeping financial plan allocates MYR1.2bn for the construction of affordable housing, plus MYR1bn for rent-to-own PRIMA houses.

It also draws out the most palatable benefits of the Home Ownership Campaign (HOC), including the much-praised Real Property Gains Tax (RPGT) exemption, now extended until December 2021. It also expands on the stamp duty exemptions, to cover instruments of transfer and loan agreements for first homes not more than MYR500,000 until December 2025. Stamp duties have also been exempted for “white knight” or rescuing contractors.

The loan moratorium introduced in April 2020, credited for staving off defaults during the pandemic, also returns with new terms under the Budget.

“One of the key determinants of the effectiveness of the series of stimulation packages is execution. There should be minimal delay in handing out the aids,” advises Foo.

Stimuli could be myopic measures in a climate of deteriorating incomes, especially in hard-hit sectors like F&B, hospitality and tourism. Unemployment last year surged to 4.5 percent, the highest rate since 1993.

“These financial aid packages are short-term in nature,” says Kumar. “Malaysia needs to enhance sustainable income levels especially amongst the B40 population.”

To improve the macroeconomic condition and restore purchasing power, Budget 2021 has earmarked MYR2bn for hiring incentives; MYR1bn for reskilling and upskilling; and MYR1.5bn for targeted wage subsidies. It also aims to generate 50,000 temporary jobs.

Market recovery is ultimately contingent on a literal remedy. The prime minister received the Pfizer-BioNTech vaccine in February, triggering the first phase of a national inoculation programme that would cover half a million people by April. The second and third phases will roll out through February 2022.

The market is likely to remain flattish until then, with uneven recoveries taking place across different sectors, says Foo. “Any improvement is likely to be evident only in the second half of 2021. If vaccination goes as planned and should we able to restore some normalcy by the end of this year, we could look forward to growth again possibly in early 2022.”

The original version of this article appeared in Issue No. 165 of PropertyGuru Property Report Magazine

Recommended

Why everyone is moving to Selangor and Johor: Malaysia’s real estate comeback

Malaysia’s upturn in fortunes is especially prevalent in secondary destinations such as Selangor and Johor

Penang’s silicon boom: How the US-China tech war is supercharging local real estate

Penang’s booming semiconductor industry has created ripples within the local real estate sector

New leader, new opportunities: How Hun Manet is shaking up Cambodia’s real estate game

Hun Manet is overseeing decent economic growth and widening access to the country’s real estate market for foreigners

Singapore embraces inclusive housing reforms amid resilient demand

The Lion City’s regulatory strength continues to exert appeal for international investors